Home loan rates, how to decide between fixed and variable

Whenever home loan interest rates (cost to you) on offer are at historically low levels, borrowers start asking if they should fix their home loan and for how long?

When considering fixed rates (should always be borrower’s decision, not the brokers, who’s looking to lock in commissions or lenders, who wants fund allocation certainty) focus should be on what cost (interest rate) you are happy to pay for the money (home loan) you’re borrowing in order to achieve repayment certainty over the fixed period.

If we take a peek at the recent past, anyone borrowing for a owner occupier home loan in June 2018 would have found that the average variable rate on offer was 4.14%, in June 2019 the average rate was 3.64% and in June 2020 average rate was 2.8%.

Six months later, loansHub customers are getting rates averaging 2.64% variable and 1.99% for 2 years fixed when buying or refinancing their owner occupier property.

Anyone borrowing in 2018 would have accepted the cost of their home loan was going to be 4.14% and made repayments accordingly similarly current day borrowers accept todays variable rates on offer, however for borrowers needing certainty, the option is to fix the cost of your borrowings for an agreed period.

One way you can decide whether fixed or variable rate is the right option for you is by comparing loan repayments based on current variable rate against your preferred fixed term rate and factoring in possible rate changes during the fixed period.

Let’s look at two examples, both $500,000 home loans, in the first scenario, the three-year fixed rate is higher than the variable rate on offer and in the second scenario, the three-year fixed rate will be lower than the variable rate on offer.

First scenario, variable rate on offer is 3.39% and a three-year fixed rate with the same lender is 3.54%.

Based on the above rates, the monthly repayments for the variable loan is $2,215 and for the fixed loan, $2,256. Annualised over three years, the difference is repayments equates to $319 extra if you fixed and over 30 years, an additional $2,606 in interest.

Now let’s consider what will happen in the event (a) the variable rate goes up by 25 bases point (b) the variable rate goes down by 25 bases point, we’ll assume this happens at the end of year 2 of the loan’s life for both events.

Had you fixed your home loan at 3.54% for 3 years, and during this period, variable rate goes up to 3.64%. The option to fix will save you $19,581 in interest payments over the life of your loan.

What if the variable rate declines by quarter of a percent to 3.14% during your fixed period? Then the borrower with the variable rate would save $24,428 in interest repayments over the life of their loan.

Let’s look at the second scenario, where the fixed rates on offer, 3.24%, is below the banks 3.39% variable rates offering. If there are no changes to variable loan during your fixed period, by fixing for 3 years, you would save $2,606 in interest payments over the life of the loan.

Now let’s consider what will happen in the event (a) the variable rate goes up by 25 bases point (b) the variable rate goes down by 25 bases point, and again we’ll assume this happens at the end of year 2 of the loan’s life for both events.

In the event the variable rate goes up during your fixed period, you would save $24,789 in interest repayments over the life of the loan and if the rate goes down, then borrowers on the variable loans would save $19,220 in interest over the life of their loan when compared to you.

In reality, when it comes to mortgage rates, no one can truly predict its direction and the variable rate will likely fluctuate dependent on the market conditions, economic stability and lenders funding cost (and bottom-line).

Fixed rates provide borrowers with an option to achieve repayment certainty however if the variable swing against their chosen position, the opportunity cost can be significant.

The opposite is also possible, if the variable rate goes up significantly compared to where the rate was fixed than borrower has ensured themselves savings over the fixed period. Yes, you can split your loan however you will still be limited to what your options are (e.g. refinancing to a better loan) by the fixed portion.

In 2021, there is a significant difference between fixed and variable rates on offer. Some lenders are offering fixed rates at a percent lower than their variable rates. For anyone fixing their loan currently, the difference between the variable and fixed rates on offer would have to change by over a percent during the fixed period for the borrower with the fixed loan to lose out.

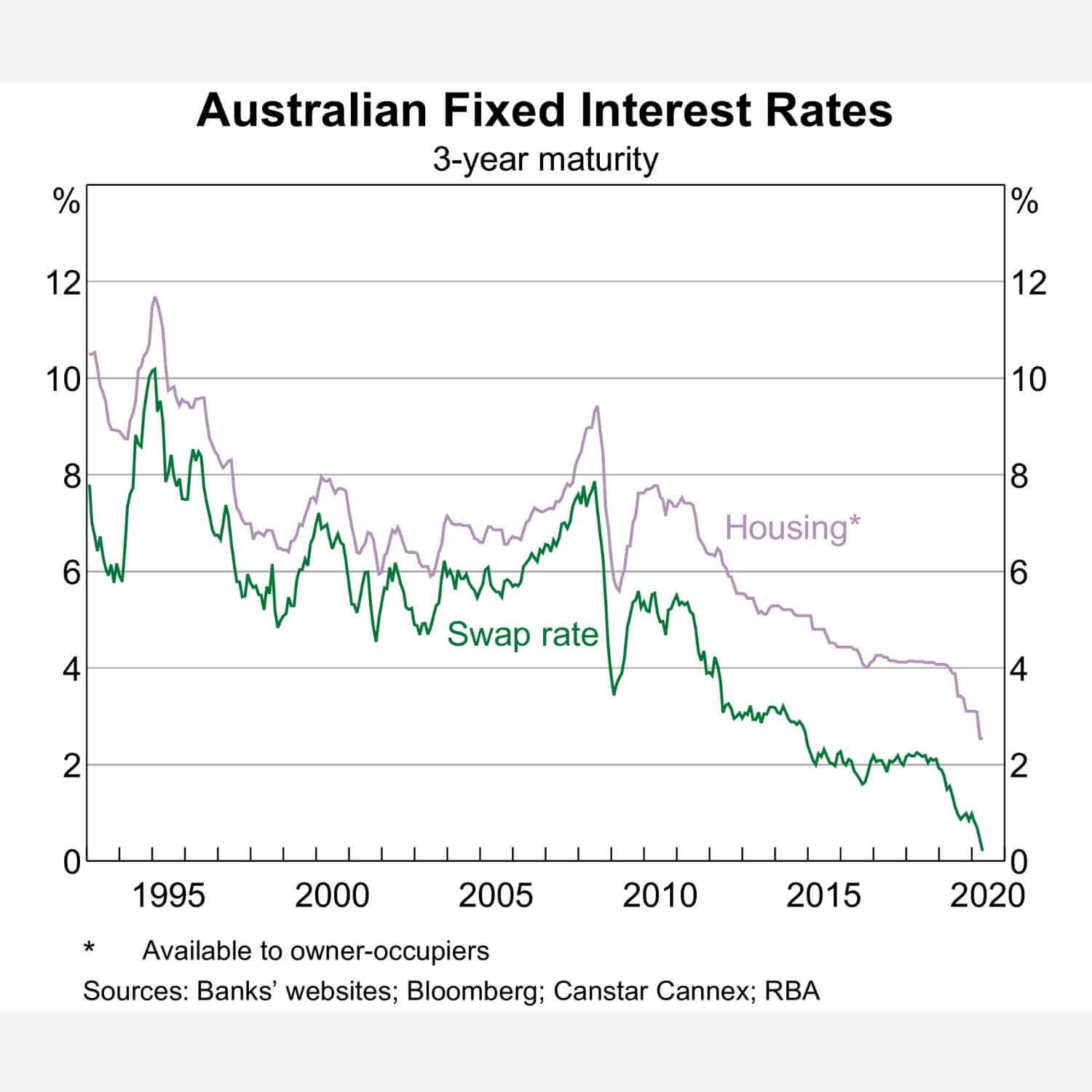

Historically, as the above comparison charts shows, fixed and variable rate mirrors each other very closely. And this is why, when choosing a home loan, the borrower should always look at the value their loan provides and the cost acceptable to them over the life of the loan.

When deciding whether to go down the fixed/ variable / split home loan option, you need to do your research on the benefits and risk of choosing anyone of these options. If you need more information, visit ASIC’s MONEYSMART website which covers the risk and benefits of these options together with examples.